Learn to manage your risk like a pro

a complement to trading

Risk management isn't just a complement to trading: it's the central pillar of any sustainable and successful strategy. In this module, Finixias offers a complete immersion into the fundamentals and advanced techniques of capital management.

the optimal size of your positions

using concrete formulas that take into account your capital, your risk tolerance, and market volatility. The module then guides you in the strategic placement of stop-losses, taking into account technical levels (support, resistance, ATR) in order to avoid early exits or avoidable losses.

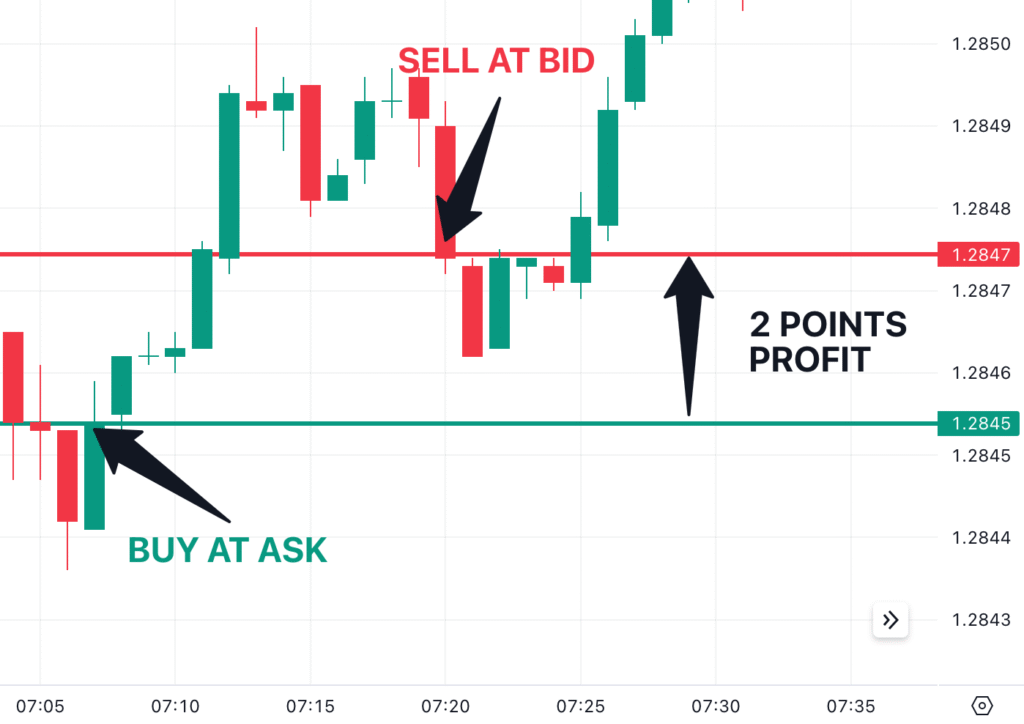

a consistent risk/return ratio

We also detail how to define a consistent risk/reward ratio, adapted to your trader profile (conservative, moderate, or aggressive). Thanks to concrete examples and simulators provided, you will be able to visualize the impact of your management decisions on your overall performance.

A special emphasis

intelligent use

Intelligent use of leverage. Too often poorly controlled, leverage can quickly become a factor in the destruction of capital.

case studies inspired by real situations

Finally, through case studies inspired by real-life situations, you will discover how professional traders adjust their exposure during periods of high volatility, how they diversify their portfolios to cushion losses, and how they preserve their capital during prolonged drawdowns.

financial defense plan

as strategic as your entry decisions. It makes you a disciplined, resilient trader capable of lasting over the long term.